According to the results of the latest Global House Price Index report, released by Quintela + Penalva, a Knight Frank partner in Portugal, average house price growth was the highest since the second quarter of 2024, although it remains below the long-term trend rate of 5.1%.

In a statement, Liam Bailey, Global Head of Research at Knight Frank, revealed that "global house price growth has recovered modestly above its long-term trend, thanks to initial interest rate cuts, but real affordability remains limited."

"We believe further monetary policy easing will be necessary this year to sustain growth at or above trend," he added.

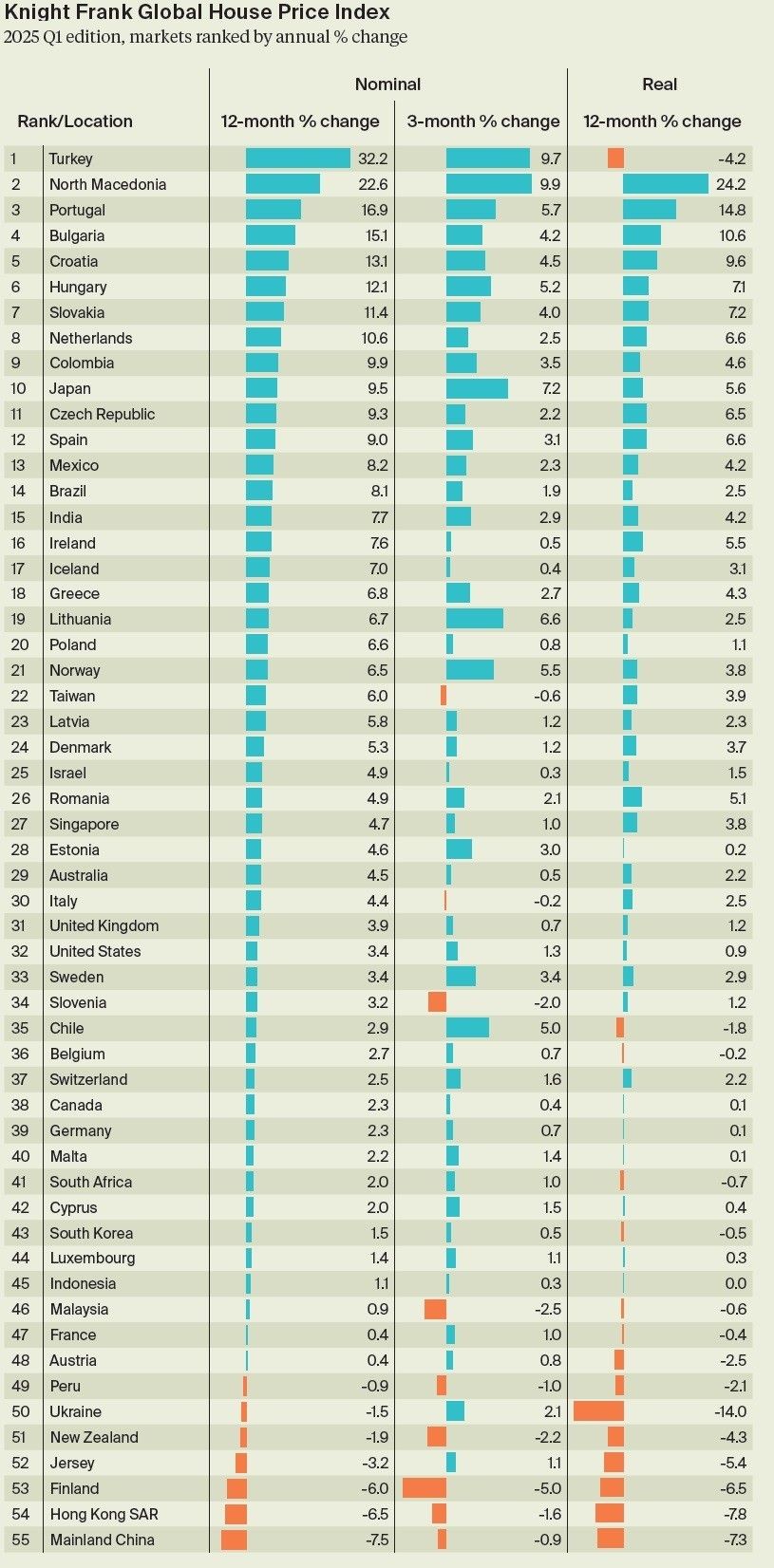

Turkey recorded the highest annual nominal growth, at 32.2%, although high inflation led to a real decline of -4.2%. North Macedonia also saw an increase of 22.6%, followed by Portugal, which, as mentioned, reached 16.9%. Following closely behind are Bulgaria, with 15.1%, and Croatia, with 13.1%.

Compared to the last quarter of last year, the domestic market grew by 5.7%, consolidating its upward trend.

Francisco Quintela, founding partner of Quintela + Penalva, says that our country "has definitely entered the radar of foreign investors seeking investment opportunities or second homes," adding that "domestic clients are also increasingly demanding and seek quality and distinctive projects."

The report also reveals that, despite the nominal recovery globally, average real growth remained negative (-0.4%), due to persistent inflation in certain regions, such as Europe and North America. Approximately 87% of markets saw positive annual growth, but the markets in Mainland China and Hong Kong saw declines of -7.5% and -6.5%, respectively.

Portugal is becoming more and more a country for the rich only! Montenegro's government will not stop until Portugal is completely taken over by the West multimillionaires with a few locals left as servants! Bunch of traitors! Better to join Spain and together become a new country called Iberia!

By A L Fernandes from Other on 26 Aug 2025, 15:13